Great to have you here. We are glad to give an update in this article about CorionX progress and the Uniswap Liquidity Incentive. Last updated on 22.02.2021.

The past few months were an amazing period. We got so much support and feedback from our community, and tremendous discussions with potential partners to design a must to have product for mainstream usage. All our efforts bore fruits. We formed several mutually beneficial partnerships that provide additional use cases for CorionX, integrations starting next month.

According to our plan, new features are coming in 2021 to extend the use cases of our existing CORX token, adding lockup staking, interoperability, yield farming, and more earning opportunities to CORX holders.

We achieved an important milestone, listing CorionX on Probit Exchange on the 16th of November and launching a 200,000 CORX reward pool Trading Competition.

The popularity of Defi and DEXes seems to be unstoppable and this trend is getting stronger according to our research. Many community members indicated that they would prefer to trade CORX on DEXes like Uniswap and contribute by locking up funds in liquidity pools to earn an extra reward.

We aim to build a strong background for CorionX token, so every user can enjoy the features and benefits of CorionX in the long term. We understood the market and our community’s demand to give an option to freely trade on DEXes and locking up liquidity for earning an extra reward.

Within our listing plans, we are going to provide some basic liquidity on Uniswap and launch a nice liquidity pool incentive program. The rationale for providing incentives to Liquidity Providers (LP) to Uniswap is to reward long-term CORX holders for promoting stronger liquidity.

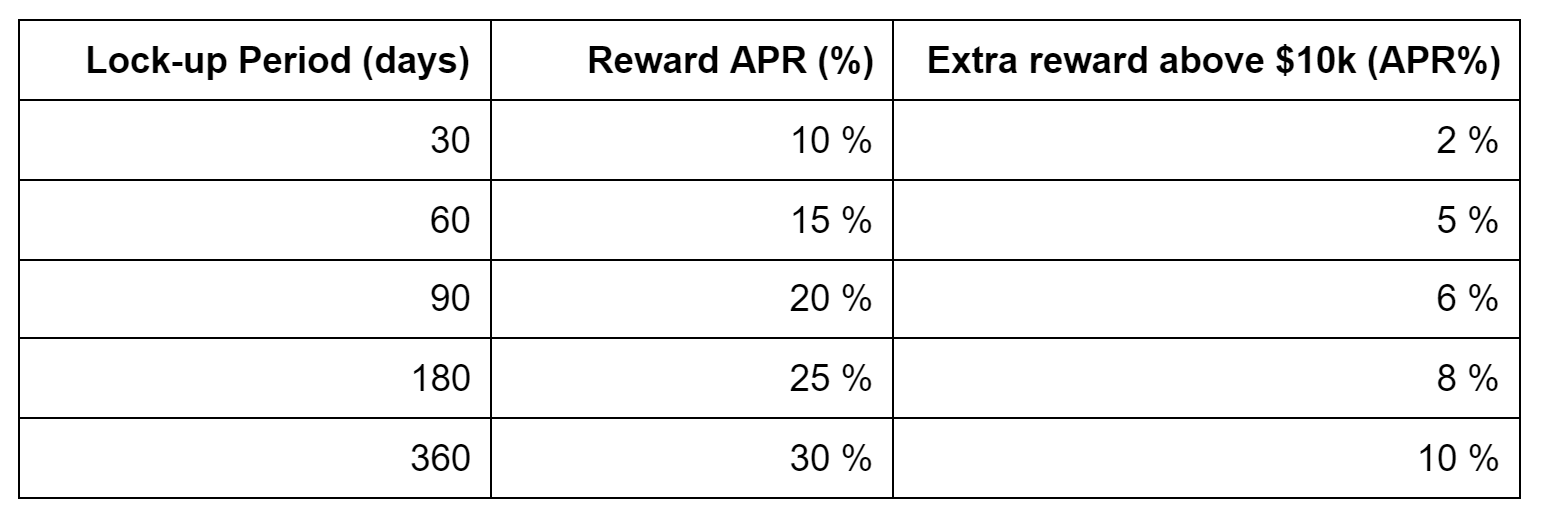

We are excited to announce the CORX Liquidity Providers Reward Program that will reward CORX LP’s who provide liquidity to CORX Uniswap Pool CORX/ETH in the following options

♦️ As Liquidity Provider you will earn from the Uniswap 0,30% trading fee in the proportion of your pool stake.

♦️ All Liquidity Providers will get a $10–100 CORX extra gift for their first time LP

♦️ Wide range of lock-up option to increase LP reward APR%

The minimum amount to lock up in the LP — half ETH and half CORX — is $3,000.

It should be locked up for a given period to earn the offered APR % reward. APR% stands for annual percentage rate.

The reward is paid in CORX at the end of every quarter.

♦️ Above $10,000 LP there is an extra reward to be paid.

We believe this LP incentive on Uniswap serves the best interest of our community and supports extending CORX use cases.

♦️ Keep in mind that Liquidity Providers (LPs), holders of CORX token, and locked up stakes will be extra rewarded.

Please fill up this Form if you provided Liquidity and want to get the rewards.

We appreciate the support of our community and partners to make CorionX outrageous.

Please note: The incentive program can be changed and closed at any time. The submitted request will be treated accordingly to the live promotion conditions when it was submitted. Corion Foundation is not responsible for any impermanent loss or profit. The liquidity provider should understand how liquidity locks up works.

Additional Information.

Who is a Liquidity Provider?

Liquidity providers facilitate robust liquidity in an ecosystem.

Anybody can provide liquidity and earn tokens as a reward for their service.

How do I provide Liquidity?

A Step by Step guide on becoming CORX Pool Liquidity Provider (CPLP) on Uniswap

1. Click on the link below👇

https://app.uniswap.org/#/add/ETH/0x26a604DFFE3ddaB3BEE816097F81d3C4a2A4CF97

2. Connect your web3.0 wallet (Metamask, Trustwallet, Coinbase wallet, etc) to Uniswap.

Look below the disclaimer, click on “I UNDERSTAND”.

{Skip point 3 and 4 if you already have CORX in your wallet}

3.Paste the contract address on the search bar.

0x26a604DFFE3ddaB3BEE816097F81d3C4a2A4CF97

4. Buy CORX if you haven’t got any. Click on the link below👇

https://app.uniswap.org/#/swap

Select the token you want to swap.

Enter the amount, and click swap.Click on CORX.

Hurray, You just swapped CORX

5. You are about to provide liquidity with a 50/50 ratio.

On the same interface click on the “ Pool”. https://app.uniswap.org/#/add/ETH/0x26a604DFFE3ddaB3BEE816097F81d3C4a2

6. Input a 50/50 CORX/ETH equivalent. Approve the transaction in your wallet.

Transaction Approved! Click on Supply👊🥰

7. Congratulations 🎉, on your LP journey, you are A CORX POOL LIQUIDITY PROVIDER (CPLP).

8. Submit your request for the LP Reward Program on this link by filling the form

Risk factors and Cost.

a. Impermanent loss and profit.

Impermanent loss/profit happens when the initial price of your deposited assets (liquidity) changes compared to when you deposited them.

The bigger this change is, the more you are exposed to impermanent loss/profit.

The loss or profit means less or more dollar value at the time of withdrawal than at the time of deposit.

b. Gas fees cost for transactions.

Adding and Removing Liquidity will cost gas to process the transaction.

🌐 Website

📑 Whitepaper — Read Whitepaper

(https://corion.io/corionx-whitepaper-en/#)

📧 Telegram — Join Group

🕊 Twitter — View Twitter Account

(https://twitter.com/CorionPlatform)

📘 Facebook — Visit Company Page

(https://www.facebook.com/CorionFoundation)

🔗 LinkedIn — View Company Page

(https://www.linkedin.com/company/corionplatform/)

📝 Medium — View Medium Page

📺 YouTube — Watch Video