Stablecoins, the utility tokens that power Decentralized Finance (DeFi) systems have seen a wave of media coverage lately, but what exactly are they and why are they so powerful in the DeFi marketplace?

Stablecoins are a new class of cryptocurrencies that attempt to offer price stability either by algorithmic seigniorage or backing by reserve assets. They are designed to minimize the price volatility of the stablecoin relative to some “stable asset” or a basket of assets, by pegging to a cryptocurrency, fiat money or exchange traded commodities such as industrial metals or precious metals like gold.

Corion Foundation, established in 2016 and headquartered in Switzerland, have created the CorionX utility token and platform with the sole purpose of promoting world-wide adoption of stablecoins, De-Fi, central bank digital currencies CBDCs, to help unbanked young people and businesses gain swift and safe access to OpenFinance.

To this effect, CorionX creates the one platform for stablecoin adoption, usage, and an open invitation to everyone around the globe to join the movement and #MoveMoneyInTheRightDirection

What Makes Stablecoins and CorionX Important in OpenFinance?

To understand this intriguing question, we need to cast our minds back to over 7000 years’ history of money. From the barter trades of 9000 BC, the first currency minted in 600 BC to the modern coinage and digital banking systems, several versions of money have existed and gained value because they are accepted as payment for goods and services.

Stablecoins possess all the characteristics and more to become useful as a store of value including portability, durability, divisibility, scarcity and recognizability, all without any trusted third parties or central authorities.

CorionX brings these features under one single movement with the following advantages:

· Unlike the incumbent traditional financial system, transactions made on stablecoins are fast, secure, and unfalsifiable

· Payments around the world to any person or business happens in seconds in stablecoins

· Transacting parties benefit from transparency and accountability using detailed analytics

· Users and businesses also benefit from low transaction fees, with transfers settled in seconds using stablecoins for cheap ‘gas’ transaction fees

· Opening an account no longer takes days but minutes, and all accessible in ERC20 wallets

· Merchants are no longer restricted to 5 day working weeks, since CorionX empowers all businesses to conduct activities at any time, 24/7 without any restrictions of service outages

· Start-ups and merchants requiring micro-payment services can also benefit from the stablecoin revolution supported by the Corion Foundation, with easy integrable online wallet accounts.

How Do Stablecoins Maintain Their Stability?

Stable assets can be described as convenience vehicles between the crypto world and the traditional financial systems. This allows merchants, ordinary users, and institutional businesses to park their assets in a stable state, away from the devaluation of fiat assets and the volatility of crypto assets such as Bitcoin and Ethereum.

Businesses across the globe can leverage these useful features of stablecoins to acquire loans, flexible credit facilities and even lending instruments available on DeFi OpenFinance systems.

In early 2020 alone, stablecoins usage have seen a 500% increase of about $2.2 Billion in January to $11 Billion in June. The rapid demand of interest in stablecoins are due to several factors including the current global health crisis. How these digital assets achieve their price stability are highlighted below:

-Fiat Asset-Backed: This scenario involves third party banks and escrow service institutions issuing stablecoins against a basket of fiat assets like USD, GBP, Yen or Euro held in a bank vault. The fiat backed assets can only be used to repurchase coins that were previously issued.

-Crypto Asset-Baked: This mechanism involves other cryptocurrencies with liquidity being collateralized against issuance of a stablecoin. The idea in a system like this relies on minimizing the risk of volatility of the collateral asset, by implementing safeguards like decentralization, multi-signature cold wallet storage vaults, privacy, and smart contracts. Stablecoins are only issued when strict conditions are met by lenders and borrowers on decentralized finance systems.

-Hybrid Asset-Backed: This system significantly reduces the risk to stablecoin price stability. Coins issued are backed by a basket of other liquid assets like fiat, cryptocurrencies, central bank digital currencies CBDC, and less liquid assets like real estate or hedge funds, brought onto the Blockchain using smart contract oracles.

This gives the system the ability to manoeuvre sudden price fluctuations, by expanding or contracting depending on markets’ supply and demand.

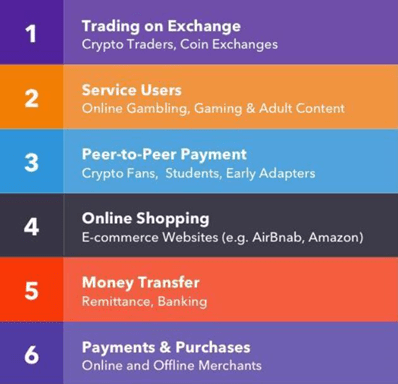

Who are the Target Group for CorionX token?

Corion Foundation aims to encourage with CorionX token the world-wide adoption of Stablecoins, De-Fi, CBDCs, and to help unbanked people globally to participate in the cheap, swift and safe OpenFinance economy.

The foundation will create a common platform that supports client focussed development of infrastructure, with a mainstream adoption target. Some of the target use cases are discussed below:

· Creating money transfer solutions for the underbanked and unbanked in the remittance industry, which was estimated to be worth US$715 billion in 2019

· Facilitating instant borderless payments between international business parties

· Creating opportunities for young generation Z people, who are familiar with new technologies

· Help privacy focused people and businesses around the world who prefer to send and receive transactions securely

· Providing alternative safe platform for citizens of countries with unstable national currencies

· Enabling online and offline merchants to make purchases and payments securely

· Helping professional institutional traders minimize risk of volatility of other crypto assets

· Helping lenders and borrowers hold their asset values in a stable state, by guarding against market price instability when they borrow stablecoins for business services development

The Case for Central Bank Digital Currencies (CBDC)

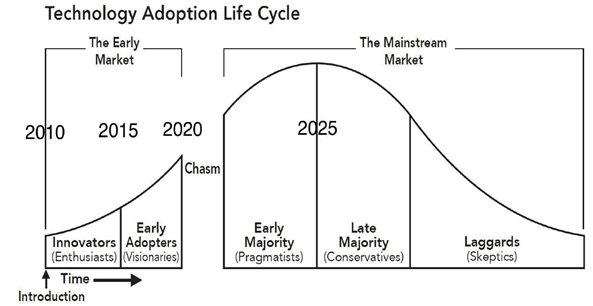

Central Bank Digital Currencies are a digital form of fiat money issued by a regulatory government or the monetary policy authorities of a country. Although the initial hypothetical idea was inspired by Bitcoin, several countries including China, Finland, Sweden among others are currently testing the proof-of-concept of their respective digital currencies.

According to documents published by the National Bureau of Economic Research in 2017, CBDCs are expected to bring clarity to national regulatory frameworks for mass adoption of digital currencies, using strong monetary policies to become high security instruments; like paper bank notes, with each unit uniquely identifiable to prevent counterfeit.

Based on the technology adoption cycle above, we are right at the cusp of mainstream adoption where CBDCs could play a vital role in streamlining implementation regulations and provides opportunities for businesses and organisations such as Corion Foundation. This promotes global education and adoption of digital stable currency ecosystems in the 21st century. Some of the advantages include:

-Technological efficiency: Money transfers and payments like remittances could be made in real time between the payer to the payee, without relying on intermediaries like banks and clearing houses.

-Monetary policy transmission: The issuance of CBDC direct to the public could constitute a new channel for monetary policy transmission, which would allow more transparent and direct control of money supply, interest rates and possibly lead the way towards full reserve banking systems.

-Financial inclusion: Money accounts that are safe at central banks could constitute a strong instrument for financial inclusion, by allowing any legal resident or citizen to be issued a free or low-cost basic bank account.

Are there any Decentralized Finance (De-Fi) Systems out there?

The concept of Decentralized Finance De-Fi, have evolved into sophisticated financial instruments designed for lending and borrowing of digital assets like stablecoins in a secure and transparent way.

De-Fi systems have grown in popularity since late 2019, probably due to the open, trusted, and global financial services offered by decentralized finance systems as ideal alternatives to traditional finance.

Stablecoins are expected to play a crucial role in the operation of these trustless, censorship resistant De-Fi systems, with projected market growth expected to exceed $15 billion by the end of 2020.

Stablecoins carry the promise of revolutionizing the digital finance space with 24/7 accessible services such as loans, savings, insurance, and commodities, available to anyone or businesses around the world securely, without the need for any third-party intermediaries or institutions.

Users of De-Fi systems primarily benefit from exclusive control over their collateral assets, privacy, flexible loan payment features, and more transparent interest rates on borrowing stable digital assets.

Future implementations of stablecoins by several wallet providers will facilitate easy access to swift transactions, any time around the world at a fraction of the cost of traditional financial systems.

Benefits of joining CorionX and the#MoneyInTheRightDirection Movement

The foundation aims to support the development and expansion of stablecoins and cryptocurrency as a safe borderless payment system, that encourages entrepreneurs, stakeholders, business institutions, students and commodity merchants to participate in the OpenFinance economy with added benefits.

· Mutual infrastructure (e-wallet services, atomic token swaps, merchant gateway and De-Fi)

· Participation in the stablecoin global campaign to #MoveMoneyInTheRightDirection

· Incentivizing the use and staking of the CorionX utility tokens for a quarterly 2.5% loyalty reward

· Identifying stablecoin projects, and exploring ways to collaborate on achieving common goals

· Business consulting, project rating and white paper review

· Reaching out to stakeholders (regulators, investors, traders, market makers, exchanges, and insurance companies) to engage them on the stablecoin movement and business collaboration

· Providing access to information about crypto asset management, Know Your Customer KYC compliance processes, GDPR compliance and non-custodial storage security best practices.

The Foundation will negotiate partnerships and white label services to promote the expansion of the CorionX user community, and the stablecoin community worldwide using a unified platform.

Early investors can participate in the 1st round IEO token sale taking place on ProBit Exchange on 20th July 2020.

Follow CorionX on Telegram, Twitter, Facebook, LinkedIn, Instagram and YouTube!

“Stablecoins & DeFi Money In The Right Direction” Movement

Stay tuned and follow the ‘Stablecoin Movement’ on Twitter, Medium, Facebook & Instagram !

Written by Richmond Afenyo